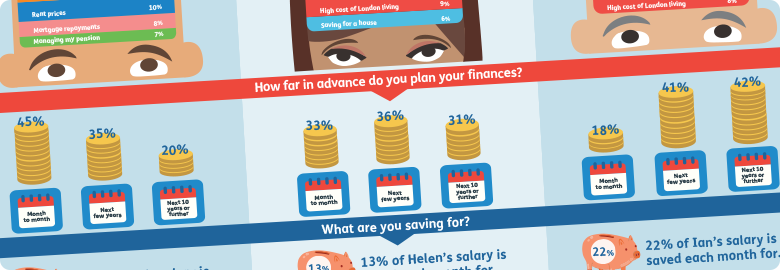

Earlier this week, the Government announced their latest financial plans. These will affect National Insurance and pensions which impact both Police Officers and their families.

These measures come at a time when much of the UK Police Family are still struggling with the cost-of-living crisis. By introducing them, the Government is seeking to reduce pressure on households allowing them to build for the future.

Here we explore the key announcements and what they could mean for you.

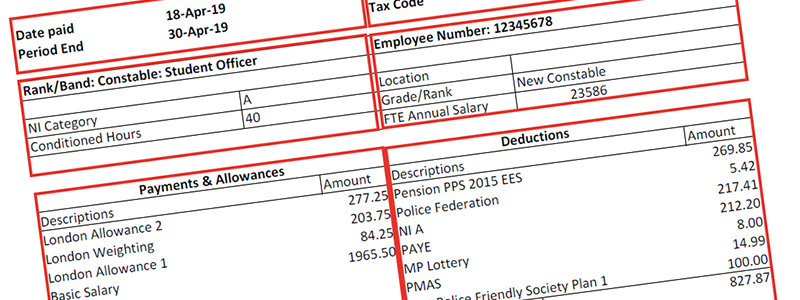

Changes to National Insurance

The Chancellor announced a cut in national insurance rates which will affect over 27 million workers including most of the Police Service. Those who earn between £12,570 and £50,270 and are in Class 1 for National Insurance have been paying 12% of their wages and 2% on earnings outside of this range. They will now only pay 10% and receive more take-home pay each month.

This provides comfort in the current climate when the Office for Budget Responsibility is reporting that disposable income per person is still 3-4% lower than before the pandemic.

For the average Police Officer earning £44,300, the changes to National Insurance will mean they receive an annual gain of over £630. (Source: gov.uk)

State Pension triple lock

State Pensions will rise 8.5% in line with the triple lock, a government promise to raise the value of publicly funded pensions. This means someone on the full new State Pension will see their pot grow from £203.85 to £221.20 per week while those who hit State Pension age before 2016 will see a rise from £156.20 to £169.50.

As a reminder, your entitlement to State Pension is based on the number of years you qualify. You'll usually need to pay at least ten years of National Insurance to get any State Pension and 35 years to get the full new State Pension. Don’t forget, you can also secure a healthy financial future for yourself by investing your lump sum pension in an ISA or With-Profit Bond too.

The state of ISAs

Despite recent pressure on the Government to make announcements regarding the current tax-free savings allowances, very little was said in the Autumn Statement about the topic of ISAs. From April 2024 you will be able to pay into multiple ISAs of the same type in the same tax year and also make partial ISA transfers. Look out for news in the coming weeks.

What do these changes mean for you?

With the uptick in disposable income and pensions, now could be the perfect time for you to invest in a bond with a guaranteed fixed rate of interest which can provide you certainty and financial safety over five years.

To find out more or get up-to-date information about key financial topics, join one of our personal finance seminars or book a call with us to talk through your savings and investment options.