Once upon a time your ISA choices were straightforward. But now there are a lot of different types of ISAs on the market and choosing which one is right for you is a lot harder.

Here’s a brief summary of the types of ISA available and what each one of them offers.

Cash ISAs

The basic cash ISA is what most high street banks and Building Societies are promoting when the new tax year comes around. They provide tax-free savings in a deposit account. They have an interest rate, which may or may not vary from year to year, usually at higher rates than normal taxed accounts. They are designed to be more flexible so taking your money out of them is generally relatively easier. However, some do lock your money in for a set period.

Stocks and Shares ISAs

These ISAs offer potentially higher returns but also carry higher risk. Your money may be invested in an investment fund or funds, or in individual stocks and shares. As well as being exposed to extra risk (and higher earning potential), money invested in a stocks and shares ISA can be more difficult to access, and it should therefore be regarded as a medium to long-term investment.

Metfriendly's ISA Monthly Savings ISA and Lump Sum ISA are stocks and shares ISAs. The Monthly Savings ISA has a guaranteed annual bonus rate and is very flexible. You can stop, restart or vary your premiums, and add to it with lump sum deposits.

These ISAs work in a different way to most other stocks and shares ISAs as the money is invested in our With-Profit Fund (a mixture of equities, corporate bonds, property and cash). The invested money earns annual bonuses and normally a final bonus (after at least three years). We also have Junior versions of both these ISA plans whereby you can put money aside for a child that will go to them when they reach adulthood.

Lifetime ISA

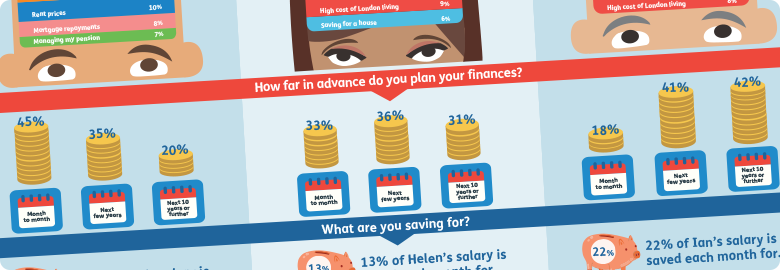

The Lifetime ISA is designed to help younger people save for a first home deposit or their pension and can be invested in cash or stocks and shares. With this ISA you can save up to £4,000 a year with the Government adding a 25% bonus to whatever is saved. This ISA is only available to new savers aged 18 to 40, but you can continue with qualifying savings until you reach 50.

Someone who opened an account at 18 and kept saving until 50 could in theory earn £32,000 worth of government bonuses and will end up with £160,000 in their account. A more realistic example could be someone who saves £200 a month. At £2,400 a year that means a £600 Government bonus. After five years at an interest rate of 4% (the top Help to Buy ISA rate), their savings will total somewhere around £16,000.

Note that the savings must be used to buy a first home (if you withdraw them before you reach 60) otherwise the government bonus will be reclaimed and a charge will apply.

Metfriendly Lifetime ISA funds are also invested in our With-Profit Fund (a mixture of equities, corporate bonds, property and cash).

Help to Buy ISA

Help to Buy ISAs closed to new savers from 30 November 2019. If you currently have a Help to Buy ISA, you will be able to continue saving into your account until November 2029.

This high-profile type of cash ISA was created by the Government in response to the difficulties faced by first-time home buyers getting onto the property ladder. Essentially the Government will top up your savings by 25% if you use this ISA to buy a first-time home. It allowed you to save £1,200 in your first month and £200 per month after that.

The maximum government bonus you can receive is £3,000, so the maximum amount you can save in a Help to Buy ISA is £12,000. The minimum saved amount required to qualify is £1,600 (giving you a £400 bonus). There are limits to the value of the house you are allowed to use this for.

Innovative Finance ISA (IFISA)

In recent years peer-to-peer (P2P) finance has grown in popularity, and the government has recognised this by now allowing this area to come under the tax-free ISA wrapper. With P2P finance you can lend directly to a borrower any amount and at any interest rate you choose. This is usually done through a specialist P2P group who help vacillate these transactions.

So for example your annual ISA allowance is borrowed by someone else, who pays you interest. You can gain higher returns with this method but this comes at a higher risk. You are relying on the strength of the facilitators own financial vetting procedures, and you also not protected by the government investment compensation scheme.

If you're ready to start saving and would like more information, take a look at our "save regularly" products or call 01689 891454 and speak to our customer services team.

Share