Black Friday this year is 24th November. Love it or hate it, it's hard not to be tempted to scour the internet for a deal.

The Black Friday and Cyber Monday events can be a great way to save money - a way to get started on your Christmas shopping, grabbing a few gifts at a reduced price, before the mad rush in December.

Spending, bargains and discounts

As with any sale, it's only worthwhile buying Black Friday items if you end up purchasing things that were originally on your wish list. So be careful not to get tempted by unnecessary bargains.

Here are six tips that could help you really make the most of Black Friday this year:

1. Sign up to alerts and comparison sites

Black Friday has become such a big event in recent years that there are now plenty of comparison sites and alert services that can help you find the best deals. Signing up for email or mobile notifications will help to ensure you don't miss out on short-term offers, and that you can get your hands on the most in-demand items before they sell out.

MoneySavingExpert lists deals from dozens of retailers and predicts which brands might be about to launch some great offers. The website is known for being a useful source of practical, no-nonsense information about money and financial affairs.

Other popular Black Friday deal aggregators include CamelCamelCamel, PriceSpy and HotUKDeals. If you're looking for deals on tech products, TechRadar and T3 are worth a look.

Also, if you work for the Metropolitan Police Service you can access the mylifestyle reward and discount scheme, which can help you get further discounts on your Black Friday bargains.

2. Look beyond Amazon

Amazon may well be your first port of call when you're shopping online at any time of the year, so it's probably the first place you'll think to go during the Black Friday sales.

There's no doubt Amazon will have plenty of special offers and discounts available for the event, offering deals from 17th to 27th November.

But it's important to remember there are plenty of other shopping sites and online retailers out there, some of which might offer lower prices than Amazon for certain products. Don't assume Amazon is always the way to go. Again, using comparison sites, signing up for alerts and shopping around will help you make an informed decision about where to buy.

3. It's not all about physical products

Lots of people use Black Friday as an opportunity to get their Christmas shopping underway, so it's often physical products that will make good gifts - like electronic gadgets, clothes and cosmetics - that dominate the promotions.

However, if you're willing to look around, you'll find that discounts are available on a much wider range of goods and services.

If you're already thinking about next year's holidays, Black Friday is a good time to search for money off flights, hotels, all-inclusive packages and more. Comparison sites like Skyscanner are useful for seeing what's available from different providers.

You can also find special offers on utilities like home broadband and mobile phone contracts in the Black Friday sales.

4. Follow brands you're interested in

One of the best ways to avoid unnecessary purchases and impulse buys that you'll regret later is to only follow certain brands. Stick to brands you've bought from and been happy with before, and those specialising in the products you really need and want to save money on.

There are plenty of ways to keep up with the best offers from your chosen brands. Social media can be particularly useful for real-time updates and alerts, or you could add your name to brand newsletter mailing lists to stay in the loop.

5. Choose wisely

Perhaps most importantly at this time of year, don't get carried away by the Black Friday hype, and take your time to make sure the things you're buying tick all the right boxes.

At the start of 2023 Oxfam reported a third of people shove unwanted Christmas gifts away in a cupboard.

So as well as scouring the internet for the best deals and the lowest prices, take the time to ask if what you're thinking of buying is really necessary, either for yourself or for friends and family. You never know - your loved ones might just want the pleasure of your company, rather than an expensive gift this Christmas.

6. Stay secure and be aware of scams

- Only buy from websites you know and be cautious of offers from unknown brands selling luxury items at bargain prices. Ask yourself – is this offer too good to be true?

- Look for the padlock symbol in the address bar. It means that your connection is secure, but be aware – it doesn’t necessarily mean the website is genuine.

- Use a secure method to pay, like debit or credit card. Don’t transfer money to a seller you don’t know – it may be much harder to get your money back should you need to.

- Be wary of spelling or grammar mistakes, and companies that don't provide an address; you could end up with a fake item.

- Avoid making a purchase on public Wi-Fi. Fraudsters may be able to hack the network and steal any personal information you share.

The alternative Black Friday

There is another way to put your hard-earned police pay to good use - one that could have benefits for you for years to come.

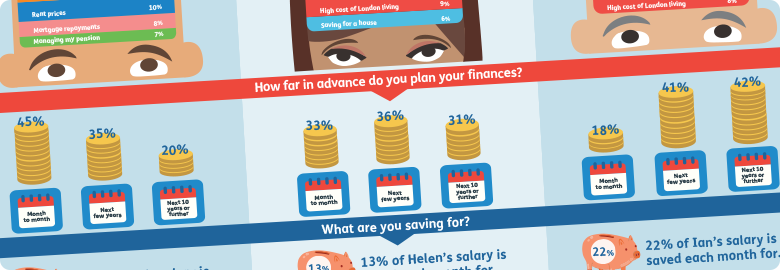

Saving little and often is not just a good habit; if you invest with Metfriendly, your tax-free savings can also attract additional bonuses and steady returns. We've been helping members of the Metropolitan Police Service save for 130 years.

If you or your kids are aged under 40 it's always worth finding out more about the Lifetime ISA, whether it's to fund a deposit on a first home or topping up a retirement fund. Why? Because the Government adds a 25% bonus to whatever you save.

Take a look if you already have a lump sum saved and you want to invest it all at once. Then, once you've used up your annual ISA allowance, you could invest the remainder into our With Profit Bond - a medium to low-risk investment that looks to deliver steady, competitive returns.

Guaranteed Five Year Fixed Rate Bond

If you're looking for certainty where it comes to investing your lump sum, look no further. This is a bond that lets you save for the future, safe in the knowledge that you’ll get a guaranteed return on your savings at the end of a fixed period of five years.

A flexible savings product that you pay into monthly. Save for home improvements, family holidays, Christmas next year or a new car. We can even deduct the savings straight from your salary if you are a Met Police officer, Met Police staff or a City of London Police officer.

Give your kids a good start in life by paying into a childrens savings plan for them. It could go towards paying for their first car, college/university fees, or a gap year to go travelling.

So why not use whatever you were going to spend on Black Friday this year and put it to good use saving for a better future for you or your family?

Want us to call you to talk through your savings options?

Click here and we'll arrange a call at a time that's convenient for you.

Alternatively, call us on 01689 891454 or email us at info@metfriendly.org.uk.

Please note, Metfriendly accepts no responsibility for content on third party websites found through this article.

Share