As I sit writing this investment update, I’m at my desk looking out at the river at home rather than the town centre in the office in Orpington. We have all had to adapt to the unusual circumstances we find ourselves in.

At Metfriendly we are operating as usual but have changed some of the ways we work so that our services can be delivered remotely to members rather than in person.

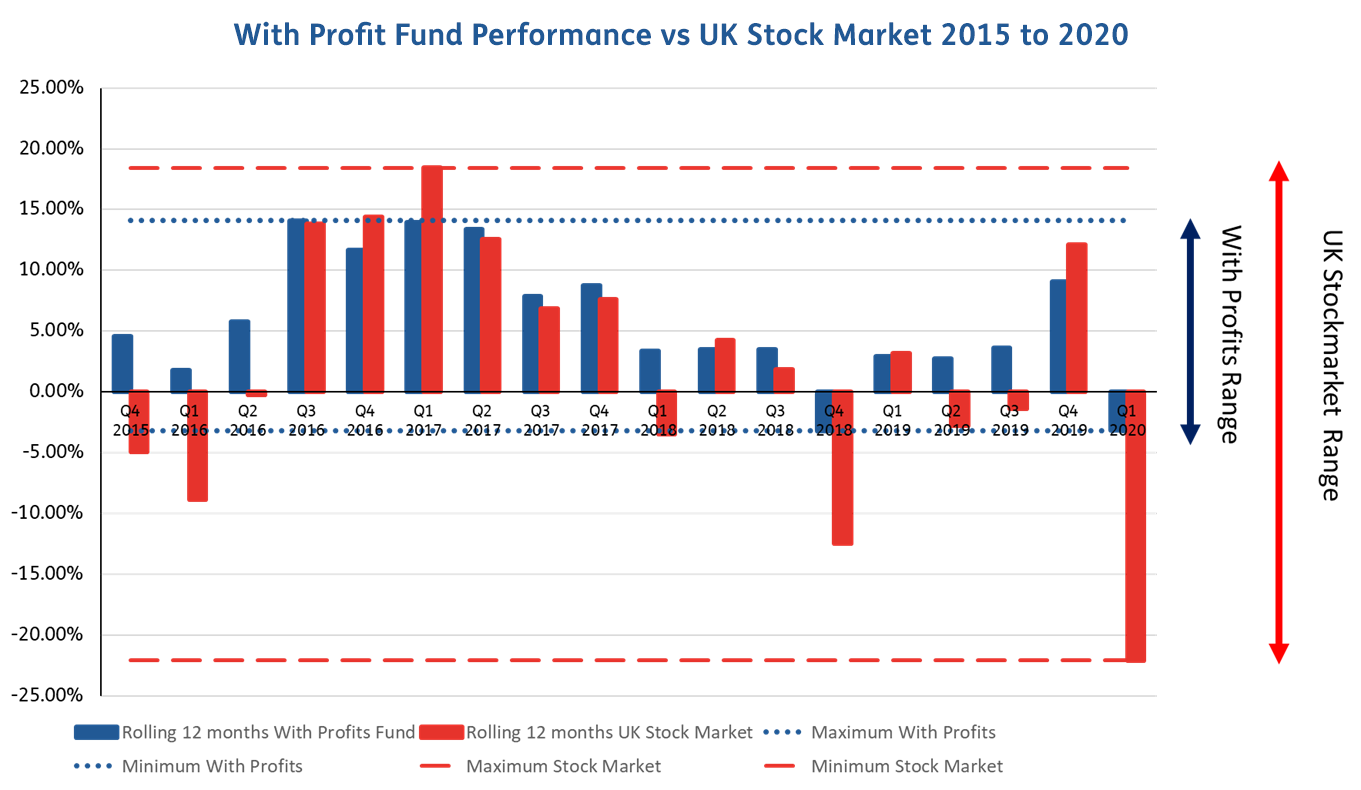

It probably comes as no surprise that since the beginning of the year, the UK stock market has fallen almost 25%. Over the same period the Metfriendly With Profits fund has fallen by only 7%. So what does this mean for members who are invested in the Metfriendly With Profits Fund? To quote Money Savings Expert, Martin Lewis:1 “There are only two prices that count the price you buy at and the price you sell at”. What this means is that when markets are down it only matters to those that need to cash in their policies early. So most members who have held a policy with Metfriendly for many years, will see very little change in the value of their ISA, With Profit Bond or savings plan.

The Martin Lewis Money Show - A Coronavirus Special Episode 1

“There are only two prices that count when it comes to shares, which is what your pension is, it’s an investment. The price you buy ‘em at and the price you sell ‘em at. The price in between doesn’t really matter, so if you don’t need to sell right now while there is no law, we hope we are going to be out of this one day. The economy was pretty good, things are going to recover, companies will start making money again and share prices will go up, so if you can wait, do.”1

This is illustrated in the graph below. This shows the rolling 12 month performance over the last 5 years for the UK stock market2 and the Metfriendly With Profits fund. The Metfriendly With Profits fund has had a less bumpy ride than the UK stock market due to our investment in a diversified portfolio of assets. This is how we balance safety and returns on member’s money. In light of turbulent markets during 2019, our investment managers have moved tactically into safer assets. In addition, they are poised to move tactically back into riskier assets when the time is right to do so.

Despite the market volatility witnessed during February and March 2020, our financial strength continues to be strong and has remained comfortably within the Society’s risk appetite target range. Our Own Funds, which are the assets we hold in addition to those required to cover liabilities to members, are estimated to cover our Solvency Capital Requirement by 2.5 times at the end of March 2020.

Finally, members’ policies are covered by the Financial Services Compensation Scheme (FSCS) for insurance policies. This means that there is no upper limit on the amount protected, unlike the FSCS Deposit and Investment schemes which are limited to £85,000 per person per company. This also means it could be a smart decision for members to bring investments together with Metfriendly as decluttering finances will make it easier to get a clear view of their savings and investments.

1 The Martin Lewis Money Show - A Coronavirus Special Episode 1 Thursday 19th March 8.30pm ITV

2 The UK Stock Market performance is based on the top 100 UK companies measured by market capitalisation