The Government has unveiled its latest Budget. Here are some of the key talking points and what they could mean for you.

Earlier this week, the Government announced their latest financial plans. These will affect National Insurance and pensions which impact both Police Officers and their families.

Black Friday this year is 24th November. Love it or hate it, it's hard not to be tempted to scour the internet for a deal.

As today's younger generations face a range of challenges in their financial lives, grandparents can play a vital role in helping their family members reach their goals and milestones.

As we have witnessed significant volatility in stock markets around the world linked to events in Ukraine we have been looking at ways to help our Members understand the impact of such financial movements on their Metfriendly investments.

Metfriendly are here to help improve your financial wellbeing. With the cost of living on the rise, it's important not to let things get out of hand, so now might be the time to review your finances and make changes. Why not look to Metfriendly to help you make some financial improvements?

Getting into good savings habits can help you achieve financial security and reach all sorts of life goals, from going on holiday (when restrictions are eased and you have more freedom to travel) to buying a home.

A quirk of Metfriendly being a Friendly Society is that some of the products it offers are unique to friendly Societies, like the Ten Year Savings plan.

Nick’s recent blog: “Things I wish I could say to my younger self” has had lots of positive feedback within the Metfriendly community and if you haven’t read it yet it’s definitely worth a look. I particularly like the idea of not spending all of your pay rise – definitely a sensible idea. As Nick[..]

It’s coming to the end of August and, despite the pandemic, for many of us its traditionally the time for family holidays and ice cream at the seaside. This month rather than talking about flavours of ice cream (Häagen-Dazs Salted Caramel for me!), I’ve been asked by a friend about different[..]

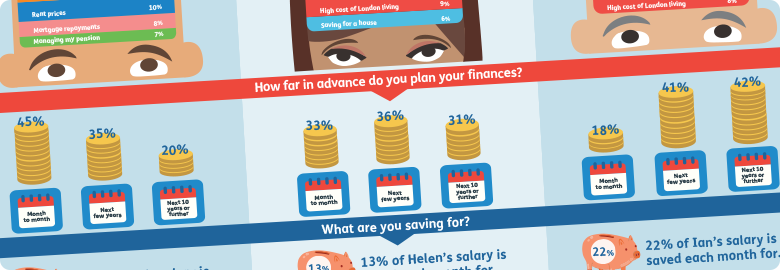

Month 1 – How to perform a quick and simple money health check.

What does the potential transfer of Police Mutual to Royal London mean for Metfriendly members?

Albert Einstein is quoted as saying “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.” He then went on to describe it as the “most powerful force in the universe”.

As I sit writing this investment update, I’m at my desk looking out at the river at home rather than the town centre in the office in Orpington. We have all had to adapt to the unusual circumstances we find ourselves in.

The current situation with regard to COVID 19 is causing a lot of anxiety and fear throughout the country but can also be causing some financial distress to some. Below are some guides, tips and links to information that might be useful to you or your family.

Metfriendly's Kathy, (centre) along with Debbie (left) and Angela (right), both presenters at our Options seminars, were recently set some interesting questions by London Police Pensioner Magazine.

Metfriendly new joiner Simon Horgan talks about why he’s passionate about helping police officers.

With Help to Buy ISAs closed to new savers as of November 30th 2019, many people will be looking at other products to help them save up money for a deposit on a first home. One option is the Lifetime ISA. Likewise, if your child has a Child Trust Fund set to mature from next year onwards, it's[..]

Our newest recruit, Joey, spoke to us about his role at Metfriendly, his parents' careers in the police and his financial plans for the future.

We're all guilty of spending time dreaming about retiring. This is particularly true when you've had a stressful day in the police service.

If you are actually approaching retirement from the police in the next few years there are so many things you will be thinking about. One of the most important[..]

Good, stable well-paid jobs can be very hard to come by, even for university graduates – and competition is fierce. Then there’s buying a home – each year more and more young adults are giving up on what was once a reasonably straight-forward decision.

Make plans for getting the keys to your own home.

Buying your first home is exciting. But saving the deposit for your first home may seem more like a far off dream. Could a Lifetime ISA help you realise your dream more quickly? Here we explain what you need to know in order for you to take advantage of your options.

Once upon a time your ISA choices were straightforward. But now there are a lot of different types of ISAs on the market and choosing which one is right for you is a lot harder.

Teaching your kids about finance early can be a great way to set them up to be sensible spenders in adulthood.

Christmas is a particularly busy time for the police, and with so many public events and celebrations it’s easy to forget about everyday concerns.

If like many parents and grandparents you are considering how you can help cover the cost of university we have put together some top tips to help you start planning and saving.