Working in the police service is demanding. Shift patterns and dealing with difficult situations make daily life hectic.

Looking forward to the future whether it’s a dream holiday, a new car or making improvements to your home, can make everything seem much more bearable. But to realise those dreams you will need to set aside some money regularly.

Do you know how much can you afford to save each month? The amount you could save might surprise you!

Start your savings journey

The key to saving is finding the right balance for your lifestyle. Unfortunately, doing quick calculations won’t often help you achieve your savings targets. You may need to make some difficult budgeting decisions. This can seem daunting, but there is a smart strategy that makes this process so simple. It’s called the 50/30/20 budget.

What is the 50/30/20 budget?

The 50/30/20 budget helps you track how much you spend and where you can save more by organising your finances into three simple categories - essentials, nice-to-haves and savings. Think of your total monthly income as a pie:

- 50% of your monthly take home salary should go on your essentials. This includes your rent, utilities, food and transport.

- 30% of your income should be used for nice-to-haves. This is everything you buy that you want but don’t necessarily need (for example holidays and entertainment)

- 20% of your income should go towards your savings. This category includes money you put aside, investments, pension and debt-reduction payments (such as credit card payments).

Why does the 50/30/20 budget work?

This approach to budgeting works for 3 good reasons:

- It’s a rule of thumb - It is a great starting point for you to start thinking about your finances and your lifestyle differently. You can take it as far as you want.

- Clarity - Putting your spending into just 3 simple categories makes your budgeting so much easier to see. This will allow you to move forward on your financial goals and have better financial stability.

- Flexibility - It works across all income levels, whether you're just starting out on a PC salary or you're an Inspector looking to retire in the next 5 years.

How to use the 50/30/20 budget

Use these 5 steps to help you work out your budget and start saving more regularly:

Step 1 - Work out your take-home pay

You can find this on your police payslip or use the government website to estimate your pay. This is your starting point to split your money into the 50/30/20 categories.

Step 2 - Calculate your essentials

Analyse your current outgoings and spending habits. Make a list of your monthly spend on just your essential spend such as food, rent/mortgage, council tax, gas, electricity, broadband, and insurance.

| Essentials | Monthly Amount |

| e.g. Rent | £ |

| e.g. Food | £ |

| e.g. Utility bills | £ |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| My Total Essentials | £ |

| Monthly Take home pay | £ |

| My % spend on Essentials (aim for no more than 50%) |

% |

Download our budget planner to help you do this in more detail. It will help you highlight any unnecessary spending and areas where you could save money.

Step 3 - Calculate your nice-to-haves

Expenditure on nice-to-haves are lifestyle choices such as mobile plans, gym membership, hobbies and eating out. Listing them out will help you identify any areas where you can make savings. Ideally no more than 30% of you take home pay should be spent on nice-to-haves.

| Nice-to-haves | Monthly Amount |

| e.g. Gym membership | £ |

| e.g. Eating out | £ |

| e.g. Holidays | £ |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| £ | |

| My Total Nice-to-have spend | £ |

| Monthly Take home pay | £ |

| My % spend on Nice-to-haves (aim for no more than 30%) |

% |

Step 4 - Calculate your savings

| Savings and Debt repayment | Monthly Amount |

| e.g. Car loans | £ |

| e.g. Monthly savings plan | £ |

| e.g. Pension | £ |

| £ | |

| My Total saving | £ |

| Monthly Take home pay | £ |

| My % spend on Savings (aim for about 20%) |

% |

Step 5 - Is your budget on target?

If your spending doesn’t align to the 50/30/20 budget start planning ways to make savings. The key to achieving your savings goals is to clear any debt first and then to save regularly. Even small savings can mount up. See our worked example below.

Worked example of the 50/30/20 budget

Take a Police Constable with an average monthly gross pay of £2,600 or earning £31,200 over a year before tax.

Step 1 - Work out take-home pay

- Estimated take-home pay roughly = £24,000

- Estimated monthly take-home pay therefore would roughly = £2,000

Step 2 - Calculate essentials

- If monthly essential spend is £1,100 it works out as 55% of take home pay

Step 3 - Calculate your nice-to-haves

- If nice-to-have spend is £700 it works out as 35% of take home pay

Step 4 - Calculate your savings

- If monthly savings (including any pension and debt repayments) is £200 it works out as 10% of take home pay

Step 5 - Is your budget on target?

- This would give the officer a 55/35/10 budget.

- If they could identify some savings and adjust their spend so that their budget was 52/30/18, they could have 8% more towards savings. This would be about £160 per month.

What could your savings look like?

By making the shift and saving per £160 per month your savings could look like this:

- In 10 years you could save - £19,200

- In 5 years you could save - £9,600

- In 1 year you could save - £1,920

These calculations do not include any interest which would be added to these figures.

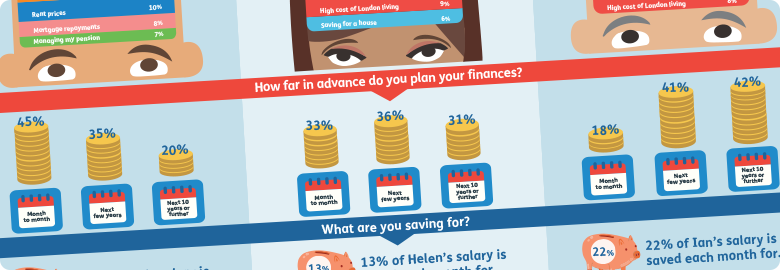

How much could you save for your future?

As you move through your career with the police service you will be able to increase your savings potential with pay rises and promotions. You will also have other opportunities to reduce bills and make extra money. Take the time every 12 months to review your spending and see if you could be saving more. The regular monthly savings you set aside can soon add up.

Conclusion

The 50/30/20 budget is a great tool to help you think differently about your money and how you spend it. It could help you on the road to better future financial stability. If this article has helped and you are ready to start saving regularly see the Metfriendly range of savings plans. If you need more help download our budget planner to start analysing your expenditure.

Remember don’t pressure yourself. Whatever you can afford to save regularly adds up over time but the sooner you take action, the faster you will achieve your goals - your dream holiday, new car or home improvements. Set up regular savings and then sit back and watch them grow.