The Government has unveiled its latest Budget. Here are some of the key talking points and what they could mean for you.

Jeremy Hunt has delivered what is likely to be the last Budget before the next general election, outlining the Government's plans for taxation, spending and the economy in the coming financial year.

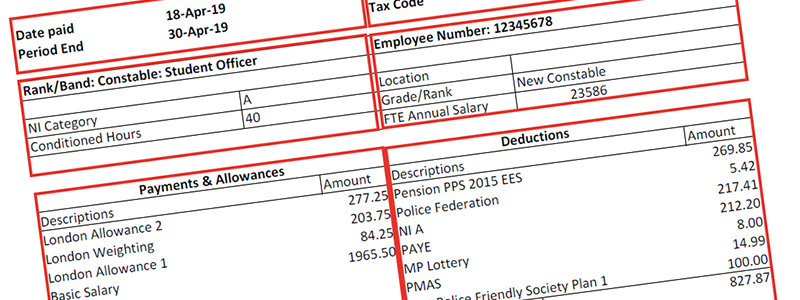

The announcement included measures that will affect how much you pay in National Insurance (NI) - the tax paid by all employees and employers that goes towards funding certain benefits and the state pension.

There were also changes to the child benefit system and some information about initiatives designed to boost efficiency in public services, including policing.

National Insurance cut by 2p

As was widely reported before the Budget statement, the Chancellor revealed that the main rate of NI will be reduced by 2p on the pound from April 6th 2024. So for every pound you earn between £12,571 and £50,270, you'll pay 2p less in this particular tax band.

This matches a previous cut announced in last year's Autumn Statement, which led to the main rate of NI falling from 12% to 10% in January. The newly announced reduction will bring the rate down from 10% to 8%.

Generally speaking, this new 2p cut will equate to an annual saving of £449 in NI contributions for someone on an average salary of £35,000.

However, it's important to consider the wider implications of other changes announced in the Budget and how they could affect your financial situation. Calculators such as this one from the Guardian can help you take a range of factors into account and work out what it all means for you.

The thresholds for both NI and income tax - which determine when you start paying these taxes - have been the same since 2021 and are expected to stay frozen until 2028.

This has raised questions over the issue of 'fiscal drag' - when workers increase their earnings, but see a larger proportion of their income being taxed because the threshold has remained the same.

Child benefit changes

If you're a parent and you earn more than £50,000, you might also have something to gain from changes to the child benefit system. Under the current rules, people with an individual income of more than £50,000 who are claiming child benefit have to pay a high-income tax charge.

From April this year, the threshold for paying this will increase to £60,000, and the top of the taper at which child benefit is withdrawn will increase from £60,000 to £80,000.

If your individual income is between £60,000 and £80,000, you'll pay a high-income child benefit charge of 1% for every £200 of your income over £60,000.

The Government claims these reforms will benefit nearly half a million families, making them almost £1,300 better off on average.

There has been criticism that the child benefit system is unfair because it's based on individual earnings, not household income. That means, under the current rules, a household with only one working parent earning more than £50,000 (or £60,000 from April) would see their child benefit reduced, while a household with two parents each earning £50,000 would receive the benefit in full.

Mr Hunt acknowledged this issue in his speech and said a consultation will be held, with the aim of moving to a household income system by April 2026.

Property tax breaks scrapped

There were also announcements that could impact some property owners and buyers, including the abolition of stamp duty relief for people purchasing more than one property. This will take effect from June 1st 2024.

A scheme offering tax breaks for owners who make their properties available for holiday lets is also due to end in April 2025.

The higher rate of capital gains tax paid on property sales, meanwhile, will fall from 28% to 24% at the start of the 2024-25 financial year.

Fuel and alcohol duty freezes extended

The Budget also included measures relating to everyday costs for consumers.

Fuel duty has once again been frozen, with a 5p cut in duty on petrol and diesel set to stay in place for another year, having previously been scheduled to end this month.

The freeze on alcohol duty, which was due to end in August, has also been extended until February 2025.

Tobacco duties, meanwhile, will see a one-off increase of £2 per 100 cigarettes, and a new tax on vaping products is due to come into place from October 2026.

Policing initiatives

In a section of the Budget dedicated to public sector efficiency, the Chancellor gave details of some initiatives that could have an impact on policing.

He said £75 million will be made available for the wider rollout in England and Wales of schemes such as violence reduction units and hotspot policing. Such projects have reportedly prevented an estimated 136,000 knife crimes and other violent offences.

The Government has also pledged to spend £230 million on time- and money-saving technologies designed to speed up Police response times. Mr Hunt referred specifically to tools allowing people to report crimes by video call and the use of drones as first responders "where appropriate".

He also said improved productivity and efficiency would help Police Officers get back some of the time they currently spend on "unnecessary admin", freeing up the equivalent of 20,000 Officers a year.

Inflation and the economy

Working people in the UK have seen their finances severely affected by historically high rates of inflation in recent years.

As far as the current and future picture for inflation is concerned, the Chancellor cited forecasts from the Office for Budget Responsibility (OBR) indicating that the rate of price growth will fall below the Government's 2% target in "a few months' time".

The OBR is also predicting that the UK economy will grow by 0.8% this year and 1.9% in 2025.

Ahead of the Budget, Metfriendly wrote to the Chancellor of the Exchequer to call for him to reform the Lifetime ISA property limit, in support of Officers trying to navigate the housing market and travel costs.

With a huge proportion of the UK’s Police Force having to live up to two hours away from their place of work, Metfriendly has called for the current cap to be increased from £450,000 and for the Chancellor to consider switching the current property cap to a personal limit of £450,000. This would mean those buying together as a couple can combine their limits to make an average-price first-time property purchase in a large city achievable without incurring a penalty charge.

We were disappointed to see that no such reforms were included in the Budget announcement.

If you've been struggling with recent increases in the cost of living and want to get a better grip on your finances, you can find out what options are available to you at one of our personal finance seminars. These events cover everything from family finances to pensions and retirement.

Alternatively, book a call with us if you'd prefer to have a one-to-one chat.