“I have a Help to Buy ISA of over £4,000, but the Lifetime ISA looks better, what do I do now?”

Saving for your first home can be one of the most rewarding, and at the same time daunting, tasks that any police officer will undertake in their lifetime. Building up a pot of money to be able to purchase your first home, which will provide safety and security for you and your loved ones in the years ahead, can be a thrilling but complicated affair.

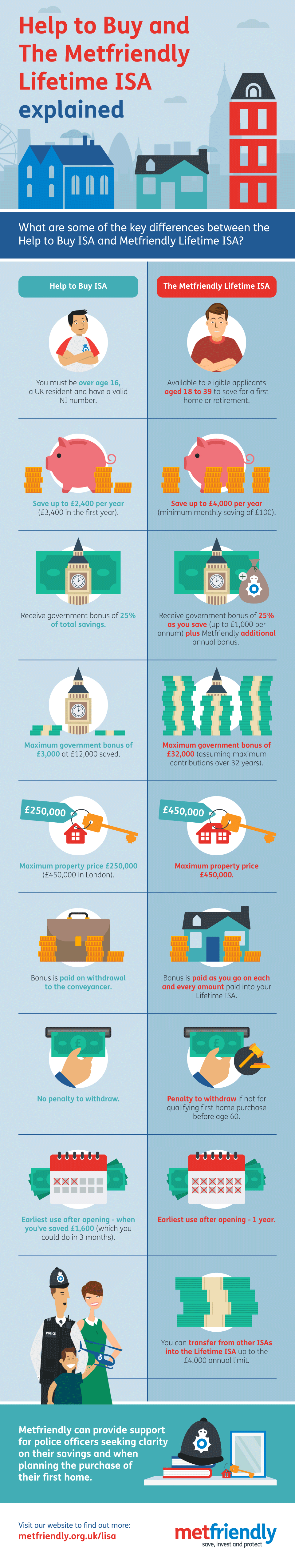

The Government’s Help to Buy scheme continues to provide support for first-time homebuyers across the country, but there are other options – including the Metfriendly Lifetime ISA – that savers should not ignore.

It’s important to note that the Help to Buy ISA closed to new applications on 30 November 2019 and is no longer available, but if you opened one before then, you can keep saving into your account and earn a government bonus towards your first home.

One important thing to remember is this: If you have a Lifetime ISA and a Help to Buy ISA, you can only use the government bonus from one of them to buy your first home.

So, what do I do now?

As you can see, each has its pros and cons, but ultimately, both products can support you in buying your first home.

The Help to Buy ISA can offer up its bonus after just three months, so for anyone seeking a short-term savings option this could be beneficial. Meanwhile, with a higher long-term bonus cap and additional bonus guarantees, the Metfriendly Lifetime ISA is an option to consider for longer-term savers.

If you’ve got more than £4,000, you can only transfer up to £4,000 per year into your Lifetime ISA (subject to Lifetime ISA limits). If you’d like to talk to us, call us on 01689 891454.

Metfriendly can provide support for police officers seeking clarity on their savings and when planning the purchase of their first home.